08 January 2024, Mumbai

Epochal moment

India's 2023 Fashion Revolution: Global Stars Strut Onto the Stage

The Indian fashion scene exploded in 2023, witnessing a dazzling entry of international brands across all segments.

Video Insights

Like runway giants strutting in designer threads, luxury names like Balenciaga under Reliance and e-commerce favorites like BoohooMAN on Myntra took center stage.

But what fueled this fashion influx, and who will be the next stars lighting up the Indian market in 2024?

Reliance: The Grand Couturier

Reliance Industries became the orchestrator of this captivating performance. Its subsidiary, Reliance Brands Ltd. (RBL), transformed into a fashion-forward force, introducing coveted luxury brands like Sandro, Maje, Valentino, and Balenciaga to India. These designer titans found a new platform to shine, solidifying RBL's position as a fashion powerhouse.

"India's rising disposable income and evolving customer preferences present a unique opportunity for luxury brands," stated Darshan Mehta, CEO of RBL, highlighting the strategic logic behind his acquisitions.

E-commerce: Catwalking onto the Scene

But online platforms weren't left behind. Myntra, the e-commerce darling, played a starring role, onboarding diverse names like BoohooMAN, Anne Klein, NEXT, Oasis, and Parfois.

This catered to a broad range of styles and budgets, making Myntra an international fashion hotspot for Indian shoppers.

"We are constantly expanding our brand portfolio and offering curated experiences to our diverse customer base," explained Amar Nagaram, CEO of Myntra, emphasizing the platform's commitment to global options.

Beyond Reliance and E-commerce: More Players Join the Party

Birkenstock, the iconic sandal brand, announced plans for 10 franchisee outlets, bringing its comfort and style to a wider audience. Social commerce stepped in too, with Trell partnering with Bestseller India to introduce European brands like Jack & Jones, Vero Moda, and Only to its influencer network.

What Fueled the Fashion Invasion?

Several factors propelled this global fashion influx:

- A Booming Market: India's rapidly growing middle class, rising disposable income, and increasing internet penetration created a lucrative market for international brands.

- Easing Regulations: The government's efforts to simplify FDI norms and foster a startup-friendly environment further strengthened India's appeal.

- Aspirational Audience: "India's young and aspirational population, combined with its strong economic growth, makes it a highly attractive market for global brands," commented Abhishek Agarwal, Managing Director of Alchemy Capital.

2024: Brands to Watch on the Runway

With its ever-evolving market, India promises to attract even more international names in 2024.

Brands like Roberto Cavalli, Dunhill, Armani Caffe, and Foot Locker are reportedly in talks, potentially through Reliance and other major players.

European and Turkish brands like Kiabi, Mavi, Damat, and Dufy are also eyeing expansion.

The Future: Bold, Stylish, and Full of Surprises

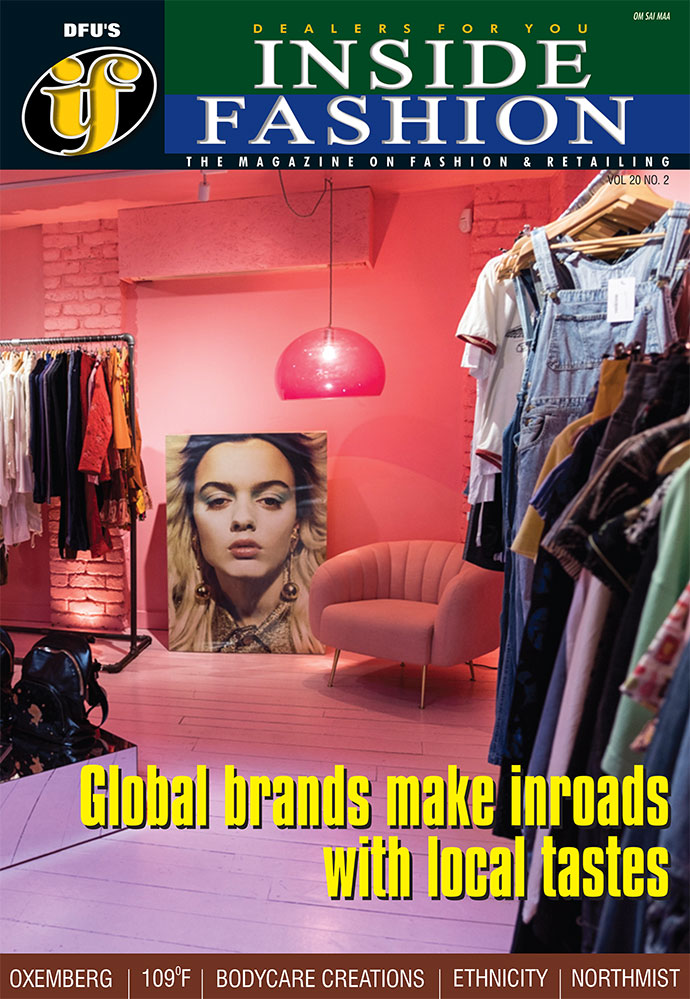

This influx of global brands promises to transform the Indian fashion landscape. Increased competition, a wider variety of styles, and improved product quality are inevitable.

Indian consumers will be exposed to international trends, shaping their tastes and preferences.

"The Indian fashion market is poised for further growth and diversification," predicted Ritu Bansal, Founder and CEO of Ritu Kumar. "We can expect to see a unique blend of global trends and Indian sensibilities emerge in the coming years."

As the Indian fashion story unfolds, one thing is certain: the future promises to be bold, stylish, and full of surprises.

This market, once a spectator on the global stage, is now taking center stage, captivating audiences with its vibrant narrative.

Gist

- Luxury Boom: Reliance brings Balenciaga, others, fueled by rising income.

- E-commerce Catwalks: Myntra onboards BoohooMAN, catering to diverse styles.

- Beyond Giants: Birkenstock joins, social commerce brings European brands.

- Market Magnets: Growing middle class, easing regulations, young consumers.

- Future Runway: Roberto Cavalli, Foot Locker next, Indian fashion evolves.

Latest Textile Events