Prudent market choices, correct pricing key to private label’s growth in India

09 May 2022, Mumbai:

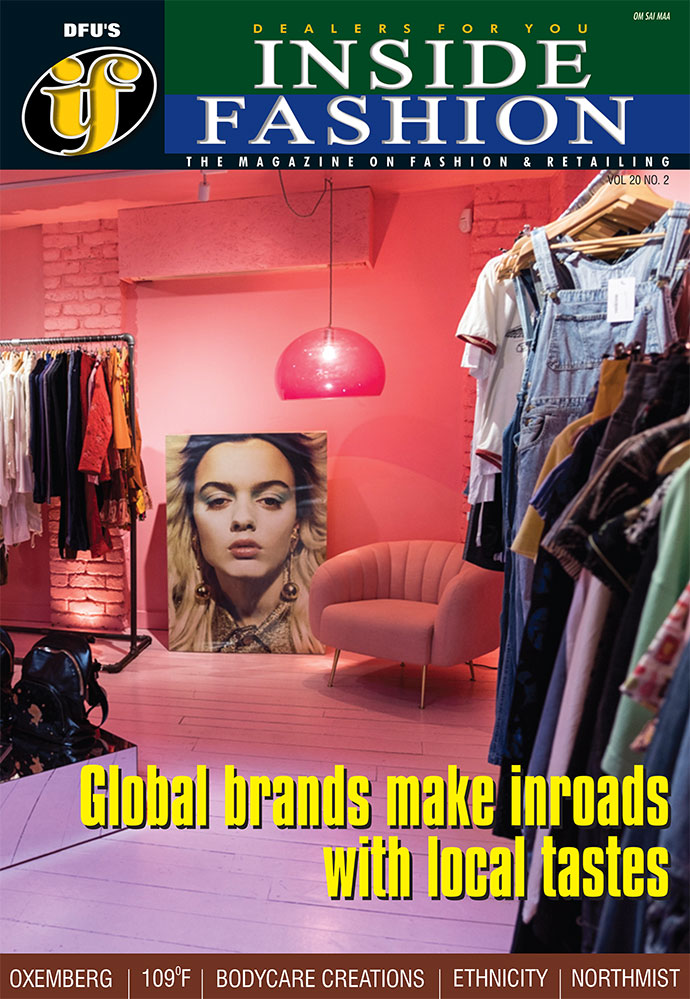

The last few years have seen private labels gaining popularity in India. Nearly all major retailers from Reliance Retail to Spencer’s Retail, Metro Cash & Carry India, and e-commerce players like BigBasket, etc have launched private labels to survive in the ever-growing market*.

A joint report by KPMG and Retailers Association of India (RAI) estimates, that the market for private labels in India is growing at 38 percent since 2016 and is expected to be worth Rs 2.94-lakh crore in 2022 from Rs 42,000 crore in 2016.

ALSO READ January retail sales restricted to 91 per cent of pre-pandemic levels: RAI

Higher sales and margins

The growth of private labels in India is being driven by higher sales and better profit margins. The KPMG-RAI report shows, that private labels offer 40-175 percent higher margins compared to regular brands. They offer the same value as regular brands but at cheaper rates, says Harish Bijoor, Strategy Specialist & Owner, Harish Bijoor Consults.

Harsha Razdan, National Leade-Consumer Markets, Life Sciences, and Internet Business, KPMG India opines, that rising disposable incomes and a growing number of online channels are encouraging consumers to switch to branded products, fuelling the growth of private brands.

The pandemic also helped private labels with retailers leveraging growth in online shopping, points out Kumar Rajagopalan, CEO, RAI.

India’s largest retail company Reliance Retail launched a range of private label brands under its fashion and apparel chain, Reliance Trends. These included Netplay for formal office wear, Performax for specialized activewear, Fusion for women’s fusion-wear, Avaasa for women’s ethnic wear, and Rio for working women’s fashion. These brands contributed 75 percent to Reliance Retail revenues this year.

RELEVANT NEWS Sanya Malhotra new brand ambassador for Shoppers Stop’s private labels

Kolkata-based Spencer’s Retail also generates 13-14 percent of its business from private labels, says Shashwat Goenka, Director. Some of its fastest-growing private brands include Smart Choice, Double Tick, and Numkeen representing major food categories, while HandsOn, Clean Home, Bath & Beauty Co. The company witnessed tremendous demand in own labels Inscapes & Kitch.

Leading fashion and apparel retailer Shoppers Stop is launching 14 private labels including Altlife, Stop, Ivy Fern, and Fratini in the fashion segment. The share of private labels in overall business has grown from 11 to 15 percent in recent years, explains Venu Nair, Managing Director & CEO.

Control over inventory and quality

Razdan believes private labels can identify the gaps with conventional brands. Another reason for their success is product positioning, packaging, attractive prices, consistent supply, and aggressive platforms across regions. However, the success of private brands is limited to the mass market segments however, retailers' plans can also target the premium price points, says Bjoor.

There is a huge scope for the growth of private labels in India, Goenka feels. However, for this, retailers need to choose markets wisely. They also need to price their products correctly to attract more consumers.

Join our community on Linkedin

CREDITS: *Business Today report