24 July 2023, Mumbai

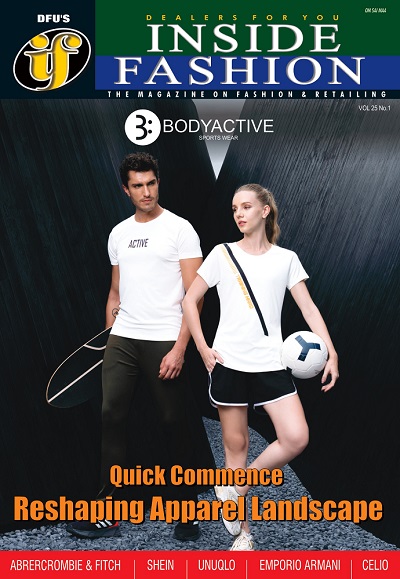

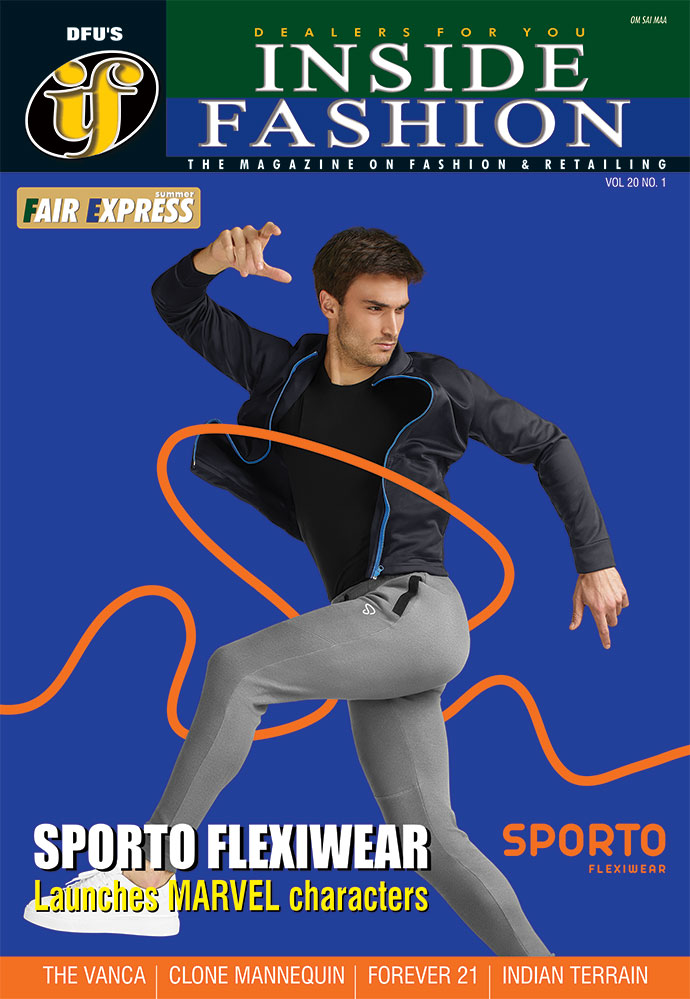

Tirupur, a leading textile hub in India, aims to achieve a remarkable 40% growth in exports within the next three years, focusing primarily on active wear.

Birds's eye view

Tirupur, India's textile hub, targets 40% export growth in activewear. Dope-dyed polyester yarns are a game-changer. Investors flock to the thriving DTC activewear market.

Athleisure remains a bright spot in the apparel industry, attracting brands and investors worldwide.

To accomplish this ambitious goal, knitters, dyers, processors, machine suppliers, dyes, and chemical suppliers must work collaboratively to make Tirupur a global sourcing hub for activewear products.

Consumers are increasingly shifting from conventional clothing to high-performance, flexible, breathable, and versatile apparel made from polyester filament yarns, drawn by the performance and comfort benefits of activewear.

The Game Changer: Dope Dyed Polyester Filament Yarns

Dope-dyed polyester filament yarns and related technologies could prove to be a game changer for Tirupur.

Exporters can leverage Techno Sportswear's state-of-the-art lab facilities to analyze their buyers' fabrics, paving the way for even more growth.

The knitwear industry is also being encouraged to diversify into manmade fiber rapidly, with promising signals indicating a revival of knitted apparel exports in the near future.

Time for Investments in Technology and R&D

Tirupur exporters are urged to seize the opportunity and invest in technology, research, and development to reap the maximum benefits of the production-linked scheme's (PLI) second edition.

With the upcoming trade agreement between India and the UK, garment exporters are hopeful of receiving more orders, expecting a 30% growth in orders throughout the year.

The Pandemic Boosted the Active Wear Trend

While the pandemic had a negative impact on the clothing industry as a whole, activewear emerged as a bright spot. It's popularity and staying power are evident as the market is projected to reach USD 276.61 billion in the next six years.

Active lifestyles, coupled with the benefits of activewear such as quick-drying, thermal resistance, breathability, chemical resistance, and static resistance, have been driving the market's positive trajectory.

However, counterfeit products and volatile raw material costs pose challenges to the global activewear market.

Activewear: Fashionably Fun and Inclusive

One of the key drivers of the segment's growth is how sports and lifestyle brands have made activewear a fashion statement. Reputable brands like Nike, Reebok, Puma, and Lululemon are driving the trend, offering sustainable, durable, and premium-quality fabrics that cater to diverse body types.

Luxury brands like Gucci and Stella McCartney have also recognized the potential and are creating exclusive activewear lines.

Retail and E-commerce: Both Thriving Platforms

The accessibility of activewear through both retail stores and e-commerce channels has contributed to its popularity.

Retail outlets are gaining popularity due to the visual appeal of brand stories and the ease of fittings.

On the other hand, e-commerce, which surged during the pandemic, remains a popular channel for purchasing activewear.

Investors Capitalize on Rising Popularity

The growing role of D2C brands

The activewear market has attracted significant interest from investors, with DTC brands seeing numerous acquisitions and IPO launches.

Notable DTC brands, such as Outdoor Voices and Vuori, are expanding their operations and attracting investments.

Additionally, rising interest from investors like Norwest GV and Forerunner Ventures is fueling the expansion plans of activewear brands.

The Direct-to-Consumer (DTC) activewear market had a bustling year in 2021, witnessing numerous acquisitions and IPOs. Some notable deals included Sweaty Betty being acquired by Wolverine World Wide,

Levi's purchasing Beyond Yoga, and Helen of Troy, the owner of Hydro Flask, snapping up Osprey.

In terms of website visits, Arc'teryx and Tracksmith were the fastest-growing DTC athletics brands, with Arc'teryx experiencing a remarkable 264% spike in monthly visits in the US.

Snapshot

Alo Yoga also saw an increase of 124%, while Tracksmith experienced a 75% hike in website visits. SimilarWeb tracked this data and also highlighted growth in equipment makers like Hydrow, Tonal, and Mirror.

The rising popularity of activewear brands has attracted investors' attention. Outdoor Voices emerged as a significant DTC brand in the activewear market, while other brands like intimate brands ThirdLove and Thinx have also ventured into the activewear category.

Athleisure or activewear stands out as a bright spot in the otherwise challenged apparel sector. DTC brands can capitalize on this trend by selling through their own channels and wholesale avenues.

Expanding Market Across Categories and Regions

The athleisure and activewear segments continue to attract brands beyond DTC, with various fashion and lifestyle brands venturing into activewear.

The global women's activewear market is projected to reach impressive figures, driven by increased female participation in fitness activities and the adoption of athleisure wear for everyday use.

Technology and Functional Properties Drive Growth

Comfort looks, and functional properties like moisture management, water repellency, and thermal regulation are key factors propelling activewear's popularity.

Brands are incorporating innovative technologies, such as sewfree bonding solutions, to offer enhanced performance and aesthetics to consumers.

With consumers actively seeking activewear with specific features and increasing interest from investors, the activewear market shows promising growth and holds significant potential for the textile industry in Tirupur and beyond.

Short message

Athleisure trends fuel lucrative activewear investments.

Investor interest in the activewear category has further fueled expansion plans for various activewear brands. Investors such as Norwest GV and Forerunner Ventures have shown interest in this growing market.

Athleisure or activewear stands out as a bright spot in the otherwise challenged apparel sector. DTC brands can capitalize on this trend by selling through their own channels and wholesale avenues.

The popularity of athleisure spans across various categories, attracting streetwear, lifestyle, and women's wear brands. Major retailers like Target and Kohl's have also ventured into the activewear market, underscoring its appeal.