25 February 2023, Mumbai

Whatever is said and done Indian apparel exports have gradually grown over the past few decades, realizing that it has become possible only with an increased focus on cost competitiveness and global quality benchmarking. Needless to state here the sector has faced different challenges at different times but steadfastly it remains a key contributor to India's economy.

We have to mention here in our paper, albeit challenges galore, Indian apparel exports continue to thrive on account of factors e.g. cost competitiveness, skilled labor, and government steadfast initiatives and the attention this enormous employment-generating sector enjoys.

Context setting

The textiles and apparel (T&C), once a sector that was a vanguard of any nation's economic prosperity and the building block of national economic prospects with most of the advanced economies of the world

The sector is known to have very complicated and long global supply chains and is responsible for generating heavy carbon footprints.

Historically, the sector is known to have been a significant contributor to the economy both generating large-scale employment and precious FOREX, is been earning a dubious status as a declining sector in developed countries, given that the manufacturing shifted gradually to Asian nations which through the years are both survived and thrived through the period of 'Trials and Tribulations'.

The deep dive

The article gives insights into the Indian apparel exports sector getting impacted by developing and under-developed countries in Asia, and global retail scenarios facing extreme challenges.

It has been witnessed that there have been no considerable shifts since November 2022 and recovery is nowhere in sight. Indian apparel exports face stiff competition from other countries like Bangladesh, Vietnam, and China of different levels but continue to grow steadily come what may.

Indian view

The garment industry will make all efforts to achieve the export target of USD 20 billion in this fiscal, Apparel Export Promotion Council (AEPC) urging the GoI as a call to action (CTA) aligning cotton yarn exports and reduce the export benefit of cotton and cotton yarn exports from India to put the sector in the fast lane.

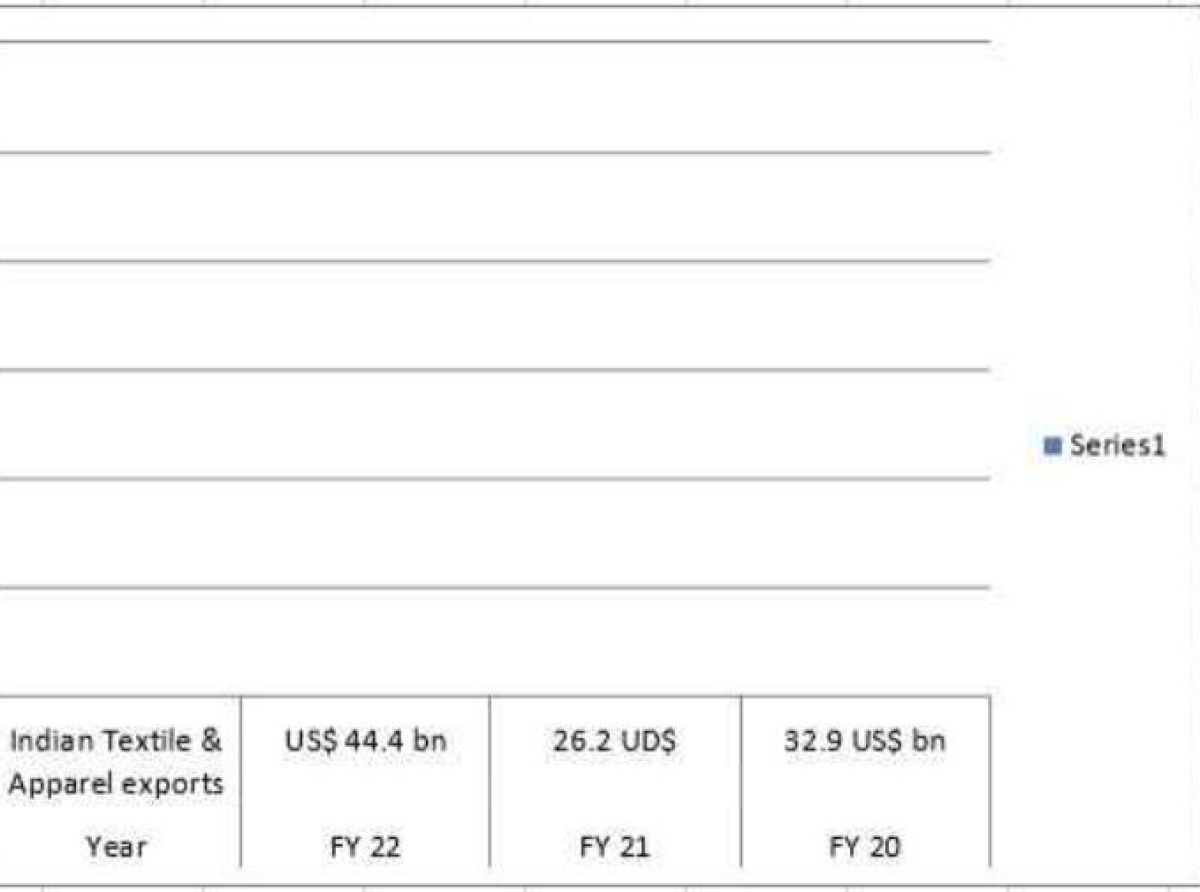

As per industry estimates," Interestingly Textile and apparel (T&C) exports increased to their historic high in FY22, hitting exports worth US$ 44.4 bn Vs 26.2 UD$ bn in FY21 showing a growth of 41%, whilst over FY20 showing 26% growth with net exports worth 32.9 US$ bn".

The good bit is India's readymade garments (RTW) exports have remained stable, with $1.5 billion worth of exports in January 2023, the same as in January 2022.

Albeit there was a 12% increase in exports in January 2021 Vs. In 2022, the US's share of apparel exports has shown a rise of 8% since 2019, while at the same time, the UAE and the UK have registered a drop in share by 3% and 1%, respectively. Giving a quick perspective the UAE and the UK's shares in the total volume of readymade garments (RMG) exports from India in January 2023 were 8% and 9%, respectively in the reference period.

Despite the lack of year-on-year (Y-o-Y) growth in January 2023, in the climate of uncertainty in the West, the argument is that may be considered a blessing that the Indian readymade garment sector is holding out in terms of export value.

The UK

Whilst when it comes to imports, the UK clearly indicated a drop in imports of readymade garments in November 2022 by 4% vis-à-vis November 2021, while imports in 2022 are 18% more in 2021 on a year-to-date (YTD) basis. Little surprise China outshined the list of countries whose exports witnessed an increase to the UK with 6%, followed by Bangladesh and Turkey with 4% and 2%, respectively, since 2019. Important to make mention here that in the same period, India's share dipped by 1%.

US's December 2022 scenario

Over here the US's apparel imports were $6.5 billion, 11% less than in December 2021, while imports in 2022 are 22% more than in 2021 on a year-to-date (YTD) basis. Noticable here is; China's share in the US market shrunk by 8% since 2019, whereas Vietnam and Bangladesh's shares have risen by 2% and 3%, respectively.

Japan

December 2022, Japan's apparel imports stood at $1.8 billion, which is equal to that of December 2021, while imports in 2022 are 5% higher than last year on a year-to-date basis. Bangladesh's and Cambodia's share increased in Japan's apparel imports by 1% each, while China's share dropped by 2% compared to 2019.

The EU

The EU's apparel imports in October 2022 were 14% more Vs in October 2021, notable is the higher percentage is all attributable to price inflation and favorable low base value. Whilst in the EU apparel market, China's share rose by 1%, whereas Bangladesh's share increased by 4% since 2019. Interestingly Bangladesh is gaining ground at China's cost in the EU market proving the adage," someone's loss is someone's gain".

January 2023: The US & the UK

There is a bit of consolation for the high retail growth in the US and the UK in January 2023. Reflecting the numbers the US's monthly apparel store sales were projected at $18.2 billion, 47% more than in January 2022, while sales were 7% more than in 2021.

Whilst the US's monthly home furnishing store sales were estimated at $5.2 billion, 6% more than in January 2022, while sales were 1% more than in 2021. In the fourth quarter of 2022, online sales of clothing and accessories clocked a growth of 5% against the corresponding quarter in 2021, and overall sales rose 7% Vs 2021.

Sharing the perspective of January 2023; the UK's monthly apparel store sales were £3.1 billion, 19% higher than in January 2022.

Long and short

Towards the end, the helicopter view of the Indian apparel exports sector presents a good showing broadly on the back of industry commitment & unwavering focus on sustainable and value-added/value accretion products.

If our industry plays the right cards, there is a big vacuum to be filled especially since China is vacating space, anti-China sentiments & China + One policy globally are starting to play out, and for once India has a real opportunity this time.

With India achieving $ 400 billion in merchandise exports, Narendra Goenka, Chairman of, the Apparel Export Promotion Council (AEPC) hopes, "India will become the world’s garment factory in the next three years. The launch of new schemes like RoSCTL, PLI, and PM-MITRA will increase the production, employment, and export capacity of one of the largest employing sectors with a maximum women workforce.

The council has launched several initiatives to promote the brand India on various global platforms by showcasing its strength in sustainability, ethical sourcing, manufacturing, labor standards, and women's employment" he adds.

Albeit not to say no industry in this highly globalized & interconnected world can be decoupled from the global contagion effect of elevated inflationary trends, surging costs, and stiff global competition that persists.

CREDITS: The Wazir February 2023 Report