10 June 2023, Mumbai

The Indian fashion sector, one of the fastest-growing in the world, is becoming more and more well-known throughout the world for its innovation, diversity, and sustainability as “Sustainable Fashion Initiatives Gain Momentum Worldwide”.

Choosing a designer with originality as suitable clothing and the ability to produce something out of the ordinary is crucial for a fantastic start and maintaining dominance in the fashion industry.

Fashion Designers: Influencing Style Choices and Empowering Society

Fashion designers hold a remarkable sway over society, wielding the power to shape people's preferences and choices in clothing.

Their ultimate goal is to inspire and captivate their target audience, enticing them to purchase their creations. One of the most prominent platforms for showcasing their creative skills and talent is through captivating fashion shows, where designers can exhibit a diverse range of meticulously designed garments.

These shows not only expose the individual talents of designers but also provide them with a valuable opportunity to promote their unique creations.

Manifestation of yourself

Fashion serves as a means of expression, allowing both the designer and the wearer to communicate their personal style and aesthetic preferences. It fosters a sense of community among individuals who share similar fashion sensibilities, facilitating connections and bonds.

The widespread influence of fashion is further amplified by the print and electronic media, which regularly feature the fashion choices and statements of celebrities, helping disseminate trends to a wider audience.

Evolving landscape

The ever-changing landscape of fashion trends creates a dynamic and competitive environment that inspires the upcoming generation of fashion designers and industry professionals to push their creative boundaries and strive for innovative designs.

This, in turn, generates numerous employment opportunities for aspiring fashion students and enthusiasts.

Timeless heritage

Fashion has a rich history that spans centuries. From the earliest days of human civilization, when people adorned themselves with clothing made from plants, animal skins, and bone, to the emergence of distinct fashion houses in the mid-19th century, the evolution of fashion has been a fascinating journey. Charles Frederick Worth, often regarded as the world's first fashion designer (1826-1895), established a fashion house in Paris and pioneered the tradition of advising customers on suitable clothing choices.

Unfolding

While fashion gained mainstream recognition in the 16th century, significant changes and advancements truly emerged in the 20th century, transforming it into the influential force it is today.

The evolution of fashion continues to shape our society, reflecting the ever-changing dynamics of culture, art, and self-expression.

Bullish outlook

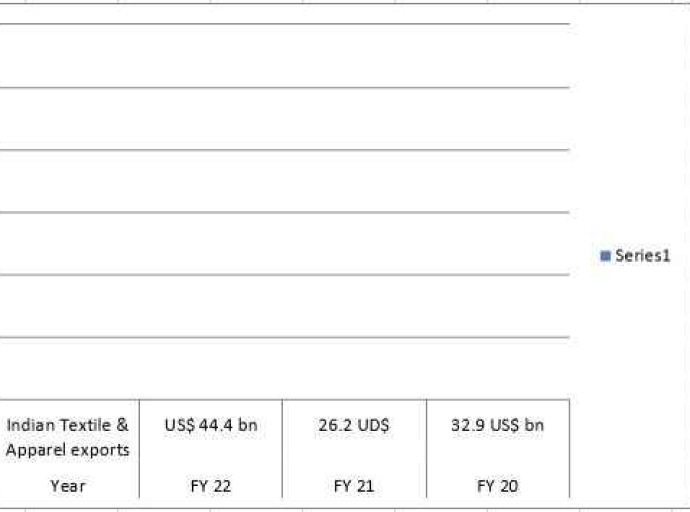

Research claims that by 2025, the Indian fashion sector will have grown at a compound annual growth rate (CAGR) of 11–12% and will be worth between $115–125 billion.

Evolving sector; However, the industry is confronting both possibilities and problems as a result of rising competitiveness, shifting consumer tastes, and technological changes.

Observation

We will examine the trends, obstacles, and possibilities facing the Indian fashion business over the next two years in this post.

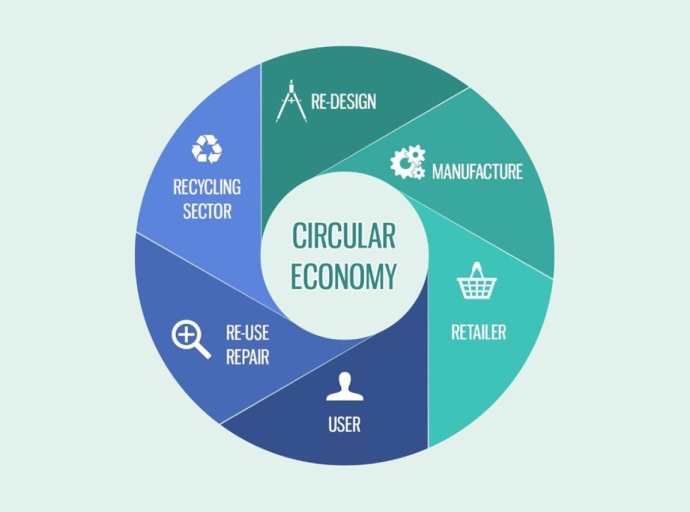

Sustainability has emerged as a major fashion trend as a result of the increased awareness of social and environmental issues.

Green is the colour to go

Eco-friendly and ethical practices are being adopted by Indian fashion firms more frequently in their supply chain, manufacturing, and marketing.

For instance, many firms are supporting fair employment practices, minimizing waste and carbon footprint, and employing organic and recycled materials.

Demand for sustainable clothes is anticipated to increase as consumers become more aware of their environmental impact.

Catalyst

The Covid-19 epidemic has sped up the fashion industry's transition to digitalization.

With the creation of e-commerce platforms, many Indian fashion firms are now concentrating on increasing their online presence.

There are many online firms nowadays that use social media for interaction and promotion.

More firms are anticipated to invest in e-commerce, virtual try-on, augmented reality, and artificial intelligence technology during the next two years, continuing the trend of digitization.

Style statement

This style is also gaining traction in the Indian fashion industry. In their designs, advertising campaigns, and communications, brands are now embracing diversity and inclusivity.

For instance, several companies are developing collections specifically for plus-size, transgender, and disabled customers, defying conventional notions of beauty.

This trend is anticipated to gain significance as customers want greater diversity and representation.

Challenges faced in the industry

Due to the entry of domestic and foreign businesses, the Indian fashion industry is getting more crowded and competitive.

Consumers now have more options than ever because of the growth of e-commerce and globalization, which makes it challenging for brands to stand out. Indian fashion firms must set themselves apart through innovation, quality, and the consumer experience if they want to stay competitive.

Supply chain disruptions

Disruptions to the supply chain, the Covid-19 pandemic has shown weaknesses in the worldwide supply chain of the apparel industry. Due to the lockdowns and travel restrictions, several Indian fashion firms had difficulty locating raw materials, making their products, and managing their logistics.

Resilience in the supply chain; To handle the uncertainties, brands must make sure their supply chain is resilient and flexible. Lack of skills: Despite the potential for expansion, there remains a skills shortage in the Indian fashion business.

What's necessary

Many fashion graduates lack the practical expertise and commercial knowledge necessary to succeed in the cutthroat profession.

Indian fashion firms must make investments in mentoring, developing talent, and working with educational institutions to close the gap.

Technology Reshaping Fashion: AI, Sustainability, and 3D Printing Revolutionize the Industry

Tech Collaboration: Fashion Meets Innovation

Tech companies like Google are spearheading transformative projects in the fashion industry. An example is the groundbreaking collaboration between Levi's and Google for the development of a smart jacket.

Fashion designers now utilize cutting-edge tools such as machine learning and AI, enabling them to create new patterns and styles and ushering in a new era for the fashion world. Innovations like bioengineered textiles and microbial leather further push the boundaries of style and material.

The Role of AI: Data-Driven Customization and Sustainability

Artificial intelligence plays a pivotal role in fashion, allowing brands to analyze vast amounts of data and personalize services based on consumer preferences.

AI also assists designers in predicting trends and reducing environmental impact during the production process, fostering sustainable practices.

Sustainability Takes Center Stage

Fashion industry leaders like Stella McCartney champion sustainable fashion, offering cruelty-free alternatives and lab-grown materials like silk.

Adidas earlier collaborated with 'Parley for the Oceans' to create limited edition sneakers made from ocean-collected plastic, promoting a more sustainable approach.

Empowering Creativity with 3D Printing

3D Printing Unleashes Creative Possibilities; 3D printing revolutionizes fashion by enabling designers to bring their wildest concepts to life. From high-end fashion to more accessible markets, 3D printing breaks design barriers, allowing the fusion of diverse materials into a single fabric.

Customization is another significant trend, tailoring garments based on individual parameters such as size and height.

The Need for Education and Awareness

Embracing technology in fashion goes beyond its visible benefits. Continuous education, and updates on projects, collaborations, and plans are crucial to amplify the value of tech integration in the industry. Stay informed on the latest developments shaping the future of fashion.

Scope of growth and improvement

India's fashion industry has significant export potential thanks to its diverse culture, skilled labor, and rich history. The demand is increasing, and several Indian fashion businesses are already exporting their products to the US, Europe, and Asia.

Indian legacy

In the international market, Indian businesses have a unique selling pitch due to the growing interest in ethical and sustainable fashion. Indian fashion manufacturers must prioritize quality, design, and innovation while adjusting to global standards and laws in order to maximize their export potential.

E-commerce market expansion

The partnership between Tech Giants and the Fashion Industry Drives Innovation as ‘Artificial Intelligence Transforms Fashion Design and Consumer Experience’ & an anticipated scenario by 2024, the Indian e-commerce market is expected to develop at a CAGR of 20% and reach $99 billion. For Indian fashion brands, this offers a big chance to connect.