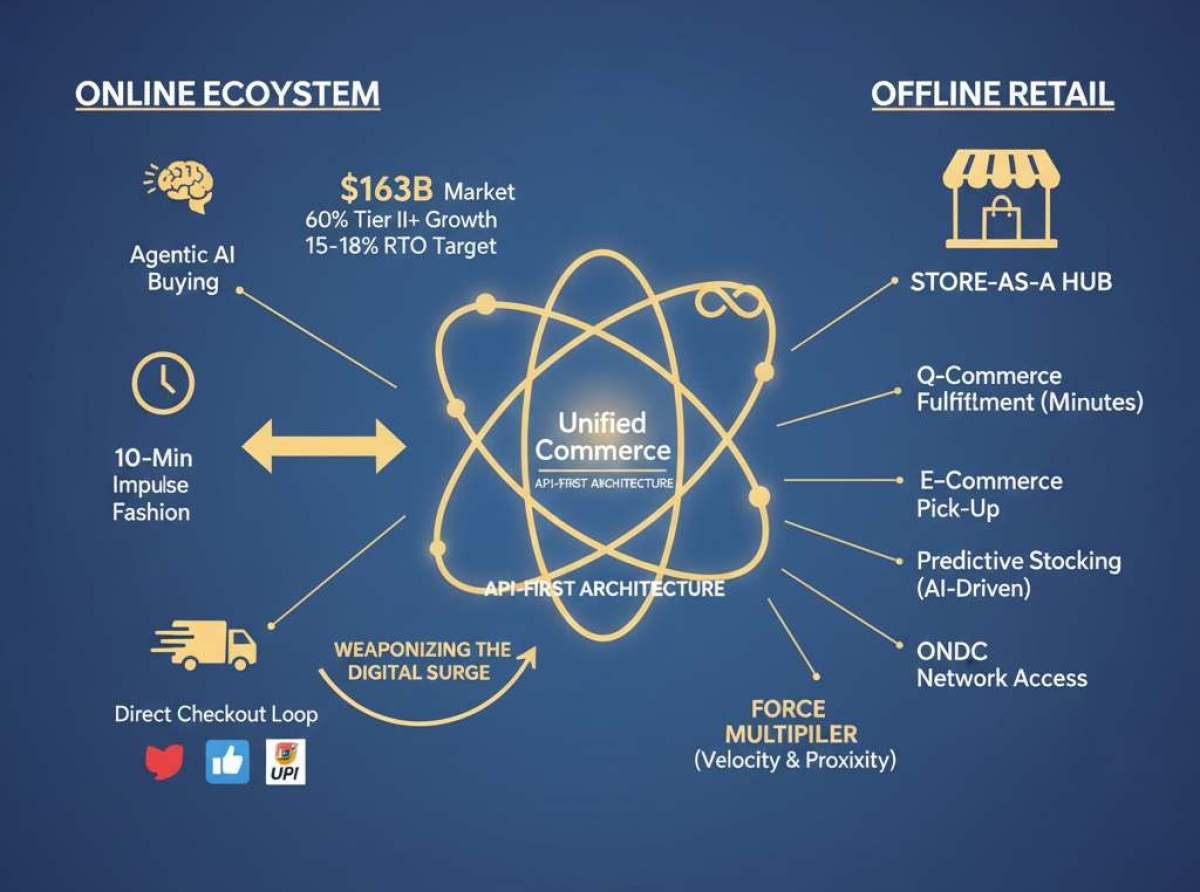

Offline Fashion Retail Goes Beyond Omni-channel in 2026: Weaponizing the $163B online surge as a ‘Force Multiplier’

01 January 2025, Mumbai

As part of our definitive annual series, "Wrap Up 2025, Outlook 2026," this feature explores the structural convergence of India’s digital and physical fashion ecosystems.

The wrap-up of 2025 has confirmed a radical shift in the Indian apparel sector: the "online versus offline" rivalry is officially dead.

In its place, a symbiotic ecosystem has emerged where digital platforms provide the discovery and physical stores provide the velocity.

As online fashion hits a $35 billion milestone—driven by a 60% surge in shoppers from non-metro Tier II and III cities—the industry is no longer looking at e-commerce as a separate vertical.

Instead, 2026 marks the year where established offline brands use their physical footprints as "Force Multipliers" to dominate a hyper-accelerated market.

I. The 2026 Online Explosion: From search bars to autonomous agents

The digital growth story of 2026 is defined by the transition from active search to "Agentic AI Shopping."

In the fashion sector, the traditional consumer journey—typing keywords like "floral midi dress" into a search bar—is being replaced by AI personal assistants that autonomously recommend and procure apparel based on a user’s digital footprint.

These agents analyze a user's style history, body measurements, and even their Outlook calendar to suggest outfits for upcoming events.

For a brand to survive this shift, leadership must shift from an "App-first" mindset to an "API-first" architecture.

If a brand’s SKU metadata isn't structured to be read by these autonomous discovery engines, it effectively disappears from the 2026 sales funnel.

Parallel to this, Quick Commerce (Q-com) has evolved from a grocery convenience into a legitimate fashion channel. By 2026, the "10-minute wardrobe" is expected to handle 15–20% of "Occasion Wear" transactions.

This "Impulse Fashion" movement, where a consumer buys a silk tie for a morning meeting or a fresh set of innerwear for a sudden trip, has forced a radical decentralization of apparel inventory. Social Commerce (S-com) has also closed the loop, moving away from "Link in Bio" friction to native, one-tap checkouts. The marketing budget for 2026 has officially moved from brand awareness to Affiliate-led Performance, where every "Get Ready With Me" reel is a direct point-of-sale.

|

Fashion Channel |

2025 Status (Wrap-Up) |

2026 Outlook (Strike Point) |

Tech Multiplier |

|

E-Commerce |

$35B Milestone / 60% Tier II+ |

Agentic AI Buying |

API-First Integration |

|

Q-Commerce |

Essentials (Socks/Tees/Vests) |

15-20% Occasion Wear |

Dark Store Proximity |

|

S-Commerce |

Influencer Hauls/Discovery |

Direct Checkout Loop |

UPI 3.0 & Native Apps |

|

ONDC |

7.5 Lakh+ Merchant Base |

Unified National Grid |

Open Protocol Interoperability |

The Offline Alignment: Physical stores as ‘High-Velocity’ hubs

The most significant strategic development of 2026 is how established offline retailers have repositioned their brick-and-mortar assets.

Far from being "anchor weights," physical stores are now the primary engines for online fulfillment. By adopting a "Store-as-a-Hub" model, brands like Reliance Trends, Max Fashion, and ABFRL are using their 3,000+ outlets as decentralized micro-warehouses.

This alignment allows them to fulfill Q-commerce apparel orders in minutes and e-commerce orders in hours, drastically cutting down the "Last Mile" costs that previously eroded digital margins.

However, the challenge for 2026 leadership lies in Data Liquidity. The rise of Omni-channel nuances means that inventory must be synchronized with zero lag across every touchpoint.

Read our latest issue

If a pair of denim is sold to a walk-in customer in a Mumbai store, that specific size and fit must be instantly wiped from the Blinkit, Zepto, and Myntra feeds globally.

Brands that have mastered this real-time "Single View of Inventory" are seeing a 25% lift in inventory turnover.

The opportunity here is massive: offline giants are leveraging their proximity to the consumer to beat pure-play digital startups at their own game, speed and fit-certainty.

The ABFRL "Unified Inventory" play

In late 2025, Aditya Birla Fashion and Retail Limited (ABFRL) demonstrated the power of this alignment.

By integrating their vast network of Pantaloons and brand EBOs into a single "intelligent inventory" pool, they reduced their average delivery time from 4 days to under 4 hours for 40% of their urban orders. In 2026, they have moved toward Predictive Stocking, where AI analyzes hyper-local social media trends in specific pin codes, like a surge in "Boho-chic" interest in South Delhi and stocks the nearest physical store with those specific styles before the demand even peaks.

This has resulted in a 20% reduction in logistical overhead and a 15% improvement in full-price sell-through rates.

|

Performance Metric |

2025 Fashion Baseline |

2026 Fashion Target |

Strategic Impact |

|

Online Share of Revenue |

18-22% |

32-35% |

Revenue Diversification |

|

Store-to-Online Fulfillment |

15% |

45% |

22% Reduction in Shipping Costs |

|

Average Delivery (Urban) |

48 Hours |

2-4 Hours |

Capture of "Impulse" Occasion Wear |

|

RTO (Return to Origin) Rate |

25-30% |

15-18% |

Improved via "Buy Online, Exchange in Store" |

C-Suite Strategic Leadership: Structurally strong but ‘Margin-Sensitive’ growth

The C-Suite outlook for 2026 is defined by Operational Velocity. The Open Network for Digital Commerce (ONDC) is acting as the ultimate leveler, allowing established brands to bypass the high "Platform Taxes" of traditional marketplaces and connect directly with the "Kirana-tech" ecosystem. Leadership must now focus on decentralizing stock and investing in unified commerce platforms that bridge the gap between a "Like" on Instagram and a delivery from the nearest store.

As Anand Ramanathan, Partner at Deloitte India, notes, the next phase of Indian retail growth is structurally strong but margin-sensitive. The winners will be those who use technology not just to sell, but to optimize.

This means moving away from the "Dumping Ground" model of discount retail and toward a Data-driven Fast-Value model, where inventory is precisely calibrated to hyper-local demand.

Editor’s Conclusion: The era of velocity

As we conclude this 2026 outlook, the narrative is clear: the most successful fashion brands are no longer those with the biggest stores or the loudest ads, but those with the most "liquid" data.

The transition from "Search" to "Service" is complete. In 2026, fashion isn't something people go out to find—it is something that finds them, precisely when they need it, delivered from a store just around the corner.