The Physical Wall: How established brands are reclaiming the High-Street from D2C disruptors

As 2025 draws to a close, the Indian fashion industry is witnessing a massive strategic shift from the digital ether back to the physical pavement.

For the last several years, the narrative was dominated by the meteoric growth of funded D2C disruptors like Snitch, BlissClub, and The Souled Store.

These players used low-cost digital entry and venture capital to bypass traditional gatekeepers, scaling rapidly on a diet of high-velocity "drops" and performance marketing. However, as we look toward 2026, the era of unbridled cash burn for customer acquisition is hitting a structural limit.

The "Physical Wall" has emerged as the definitive moat for established brands like ABFRL, Raymond, and Arvind Fashions, who are now leveraging their institutional balance sheets and deep supply chains to reclaim the high street.

Read our latest issue

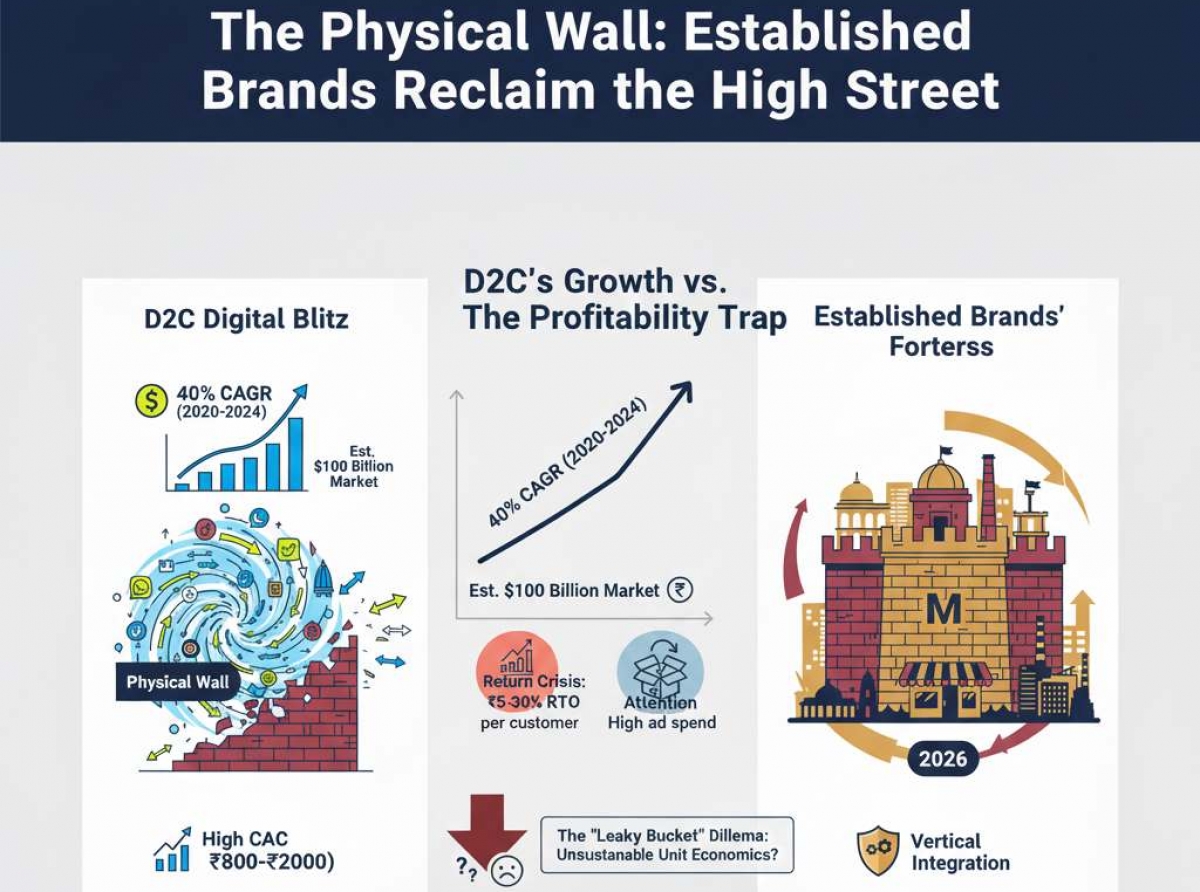

The D2C sector in India grew at a staggering CAGR of 40% between 2020 and 2024, reaching an estimated market value of $100 billion by 2025.

This growth initially blindsided the market, forcing established retailers to defend their territory against players who operated without the baggage of legacy overheads.

This "blitzkrieg" triggered a period of margin compression as giants were forced to discount heavily to match D2C prices.

Furthermore, established players faced a "trend lag" where the 15-day design cycles of disruptors made traditional six-month calendars look prehistoric.

Digital-first brands also mastered "thumb-stop" marketing, siphoning off the top-of-the-funnel traffic that previously flowed naturally to shopping malls.

But the tide is turning. The "Physical Wall" represents a shift where the cost of digital-only growth has become prohibitive.

Customer Acquisition Costs (CAC) for fashion in India now range from ₹800 to ₹2,000, often swallowing 50% of the total order value.

This "leaky bucket" makes the stability of a physical storefront not just attractive, but essential for survival.

Redefining the 2026 Competitive Matrix

|

Strategic Pillar |

Funded D2C Disruptor Move |

Established Brand Strategy (2026) |

|

Capital Efficiency |

High "Cash Burn" for reach; high CAC. |

Focus on Customer Lifetime Value (LTV). |

|

Supply Chain |

Third-party/White-label (Flexibility). |

Full Vertical Integration (Cost Control). |

|

Real Estate |

High-street "Hype" stores in Tier-I. |

"Lease Lock" in Tier-II/III (Bharat Expansion). |

|

Logistics |

Q-Commerce reliance (10-30 mins). |

Omnichannel Mirroring (Ship-from-Store). |

|

Product Cycle |

14-day "Fast-Fashion" drops. |

12 "Monthly Capsules" (Agile Manufacturing). |

Securing the "Bharat" perimeter through real estate

The most aggressive tactical shift for 2026 is the "Lease Lock" strategy. In the first half of 2025 alone, funded D2C disruptors doubled their retail footprint, accounting for nearly 18% of all retail leasing in India.

While this influx triggered a bidding war in premium Tier-I malls, established brands are moving beyond the saturated metros.

The battle for "Bharat" is now being fought in the commercial hubs of Ludhiana, Indore, and Coimbatore, where leasing volumes have surged by over 20%.

Established players are securing long-term, ten-year leases with escalations tied to store performance rather than market speculation, effectively locking out smaller competitors who lack the capital for such commitments.

This strategy is bolstered by the "Compact-Format Advantage." By utilizing smaller, 800–1,200 sq. ft. Exclusive Brand Outlets (EBOs), established brands achieve a "Density Advantage" that disruptors cannot easily replicate.

These stores act as physical anchors for an omnichannel strategy, providing a touch-and-feel experience that reduces the industry-standard 25–30% online return rate to less than 12% through in-store trials and local pick-ups.

Weaponizing the supply chain

The true strategic advantage of established brands in 2026 lies in their ownership of the "loom."

While D2C brands often struggle with quality inconsistencies and "leaky bucket" unit economics due to their reliance on third-party manufacturers, legacy giants like Raymond and Arvind own the entire value chain.

As one CEO of a legacy apparel conglomerate noted, "Cash is a tactical tool, but a resilient supply chain is a strategic weapon. While disruptors won the battle for clicks, the war for the wardrobe is won by those who control the margin at every step."

By 2026, these established players are redefining their manufacturing into 12 "Monthly Capsules" rather than the traditional two-season calendar. This allows them to match the visual velocity of Instagram-first brands while maintaining a much lower cost-per-unit.

Unit Economic Comparison (Estimated 2026)

|

Metric |

Funded D2C Brand |

Established Vertical Brand |

|

Gross Margin |

55% - 60% |

65% - 72% |

|

Marketing/CAC |

25% of Revenue |

8% - 12% of Revenue |

|

Logistics/Returns |

15% (High RTO) |

6% (Store-led fulfillment) |

|

EBITDA Margin |

5% - 8% |

18% - 22% |

Transforming stores into service hubs

Established brands are also redefining the role of the retail associate. By training floor staff to act as "Style Influencers," they are using the physical store as a studio for social selling.

Staff manage localized WhatsApp groups and live-stream styling sessions for their top customers, creating a deep-rooted loyalty that algorithms cannot manufacture.

This human-led approach is a direct counter to the "Utility-First" model of Q-Commerce.

While platforms like Zepto deliver basics in under 15 minutes, established brands are using these platforms as "Dark Store" partners.

By leasing sections of underperforming Tier-I stores to Q-commerce players, they capture a customer via a utility purchase, like socks or t-shirts and then use that data to drive them toward a high-margin, occasion-wear purchase at their nearest physical flagship.

C-Suite 2026 Strategic Outlook: Resilience over burn

The financial focus has shifted toward a "P&L Correction." The market is no longer rewarding top-line growth at the expense of profit.

This has led to the rise of "Inventory-as-a-Service" (IaaS), where physical stores act as zero-inventory showrooms and orders are fulfilled from localized micro-fulfillment hubs, effectively turning deadstock into a thing of the past.

Arvind Fashions, for instance, reported a 27% year-on-year increase in profit in late 2025 by shifting toward a consignment-led model and increasing their EBO contribution to 43% of total revenue, proving that scale and physical presence are the ultimate stabilizers.

Editor’s Conclusion: The great synthesis

The narrative of "Established vs. D2C" is maturing into a story of "Scale vs. Speed." The most successful players in 2026 are the ones who synthesize the two: adopting the digital agility of disruptors while using the physical store as the ultimate high-margin fortress.

The "Physical Wall" is not a barrier to innovation; it is the foundation upon which the next decade of Indian retail will be built. In 2026, the brands that thrive will be those that realize the high street is not just where you sell, it’s where you win.