Smaller cities drawn more towards online shopping as their spends increase Study

10 July 2023, Mumbai

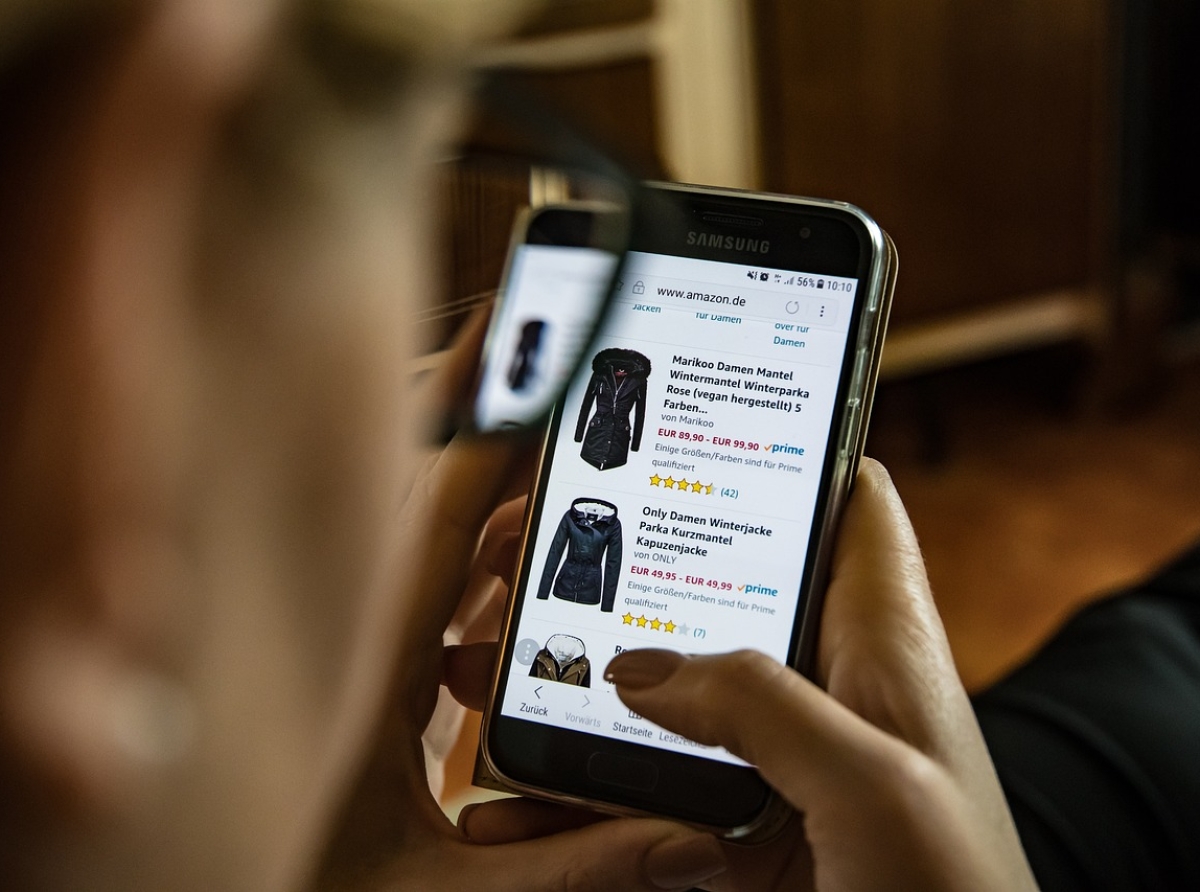

With one of the youngest populations in the world who are net savvy, there is an unprecedented growth in e-commerce propelled by the widespread use of smartphones and high-speed internet in India.

Major e-commerce players like Amazon and Flipkart, niche market players like Meesho, Nykaa, Snapdeal, and conglomerates like Tata and Reliance among others have taken over the online shopping bandwagon.

What works for them is competitive product prices with discounts, the convenience of return and exchange, and the sheer variety of products where physical stores sometimes cannot compete.

Small-town consumers ruling online shopping

A May 2023 study ‘CMR Consumer Aspirations and e-commerce in Bharat’ by India’s leading marketing research and consulting agency Cybermedia Research (CMR) has put the spotlight on the tremendous growth of online shopping in the country.

The study covering around 3,000 consumers spread across Delhi, Mumbai, Bangalore, Bhubaneswar, Nagpur, Coimbatore, Lucknow, and Guwahati, revealed there is significant growth in online spending in Tier II and III cities who so far had lagged behind Tier I cities.

Educated consumers from Tier II cities and beyond dedicate an average of two hours and 25 minutes per week to online shopping which translates to around 16 per cent of their income.

Small-town consumers now have far greater disposable income due to their lower costs of living and higher wages coupled with an increased desire for a global aspirational lifestyle.

Bengaluru and Mumbai lead the way

After luring Indian shoppers into a virtual world of domestic and international brands in the pandemic days, these websites have kept up their USP of couch shopping. Bengaluru as India’s most tech-savvy city leads with a maximum of four hours and two minutes weekly on online shopping.

Tier II cities like Guwahati, Coimbatore, and Lucknow are also leading in terms of time spent shopping on e-commerce. Both Tier I and II buyers are almost equal with an average spend of Rs 20,100 and Rs 21,700, respectively.

Mumbai consumers have the top spot in terms of average spending on online shopping with an average of Rs 24,200 annually; Nagpur and Coimbatore follow closely with an average spend of Rs 21,600.

Interesting observations

The CMR study has shown that two out of every three consumers have spent up to Rs 20,000 on online shopping in the past six months. Women entrepreneurs are the trendsetters spending 149 hours annually on e-commerce and 29 per cent have purchased value-for-money smartphones worth Rs 15,000 to 20,000) online.

Generation Z at 51 per cent shop far more frequently online as compared to millennials comprising 47 per cent, who are still not so tech-savvy. The study also shows 86 per cent of consumers rely on social influencers and other published materials while making purchase decisions, which sometimes overrides their own.

Trends

Also, 90 percent of males depend on influencers’ reviews compared to 80 per cent of females, who usually know what they want

With post-pandemic educated inter-savvy consumers spread across pan-India, retailers now need to spread out their marketing strategy making further inroads into the untapped smaller markets with greater potential to keep their online profits soaring.

Latest Publications