Q3 Retail Round-Up: Value, experiences, omnichannel key as winners adapt, losers struggle

30 January 2024, Mumbai

An overview

The Indian retail landscape presented a fascinating dichotomy in the third quarter of FY24, with some major players sprinting ahead while others stumbled.

Here’s a look at the financial figures and strategic choices that shaped their contrasting performances, along with insights and a glimpse into the sector’s future.

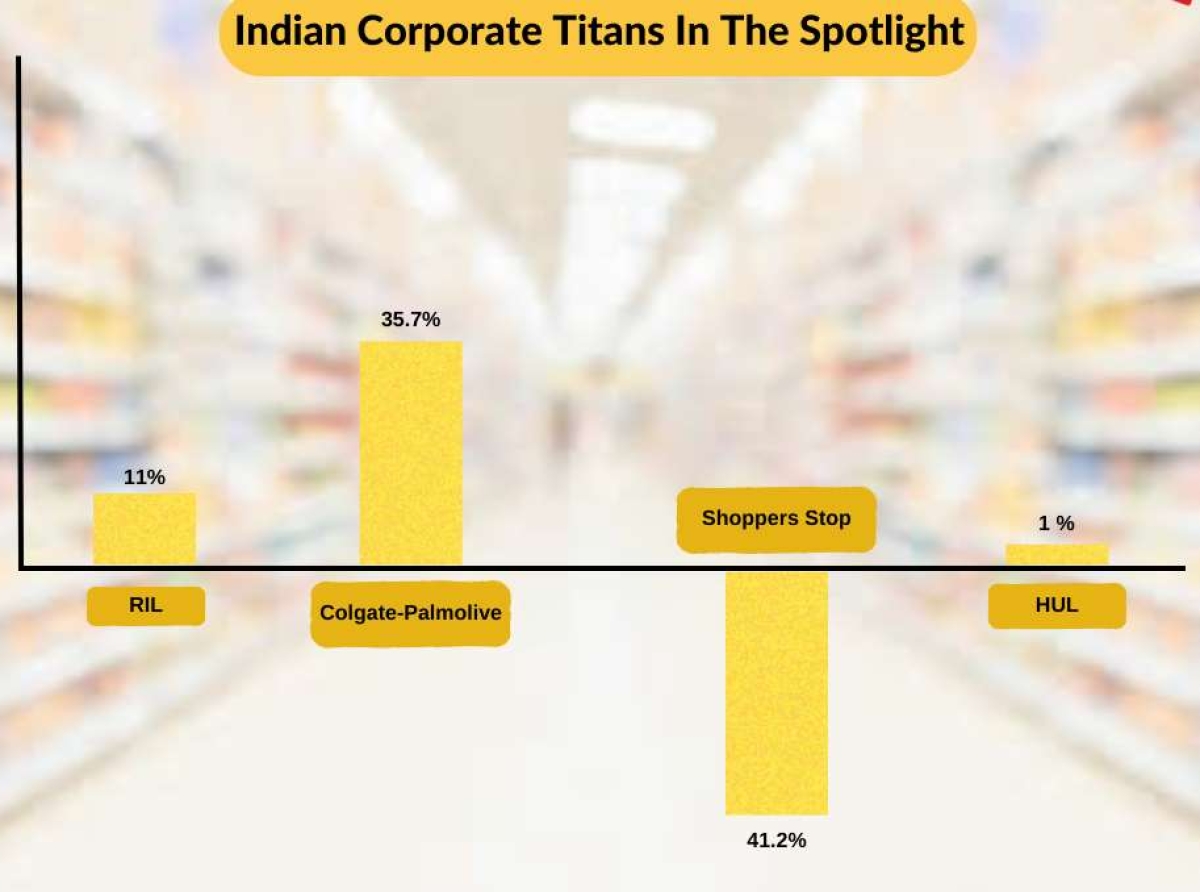

What Worked for the Winners: Focus on growth and innovation

Shopper Stop: Defying slowdown, Shopper Stop moved ahead with 7 per cent YoY growth in Q3 sales, driven by a multi-pronged strategy. "We have demonstrated remarkable resilience in these tough conditions," remarked Kavindra Mishra, Executive Director and CEO, attributing the success to a 10 percent growth in the beauty segment (led by a 41 percent jump in fragrance), expansion through new formats like Intune, and a focus on premiumization. Their commitment to personalized experiences, evident in 266,000 makeovers and 138 masterclasses this quarter, further bolstered their appeal.

Westside: Not far behind, Westside clocked a healthy 5 percent YoY growth, fueled by a strong demand for private label brands and a focus on value-driven offerings. "Our efficient inventory management and targeted promotions have resonated among customers," said Westside spokesperson

Why Some Lost Out: Stagnation and restructuring challenges

Lifestyle: In contrast, Lifestyle witnessed marginal 1 percent YoY growth, indicating a need for strategic re-evaluation. "Reliance on traditional department store formats might be limiting their growth potential," opined Ashish Gupta, a retail analyst, suggesting a need for exploring new formats and experiences.

Pantaloons: The ongoing restructuring process continued to cast a shadow over Pantaloons. CREDITS: Data collated from various sources