The $250 Billion Fashion Mandate: Why Gen Z is the fashion & apparel industry’s $2 Trillion economic engine for 2026

05 January 2025, Mumbai

This feature story is part of our exclusive year-end intelligence series, "Wrap Up 2025, Outlook 2026," designed to equip B2B leaders with the strategic foresight needed to navigate the next 12 months of retail disruption.

As the curtain falls on 2025, the Indian fashion and apparel industry has moved beyond the point of "observing" Gen Z; it has been fundamentally colonized by them.

For every stakeholder in the brand-to-retail value chain, the numbers are no longer just impressive; they are an ultimatum.

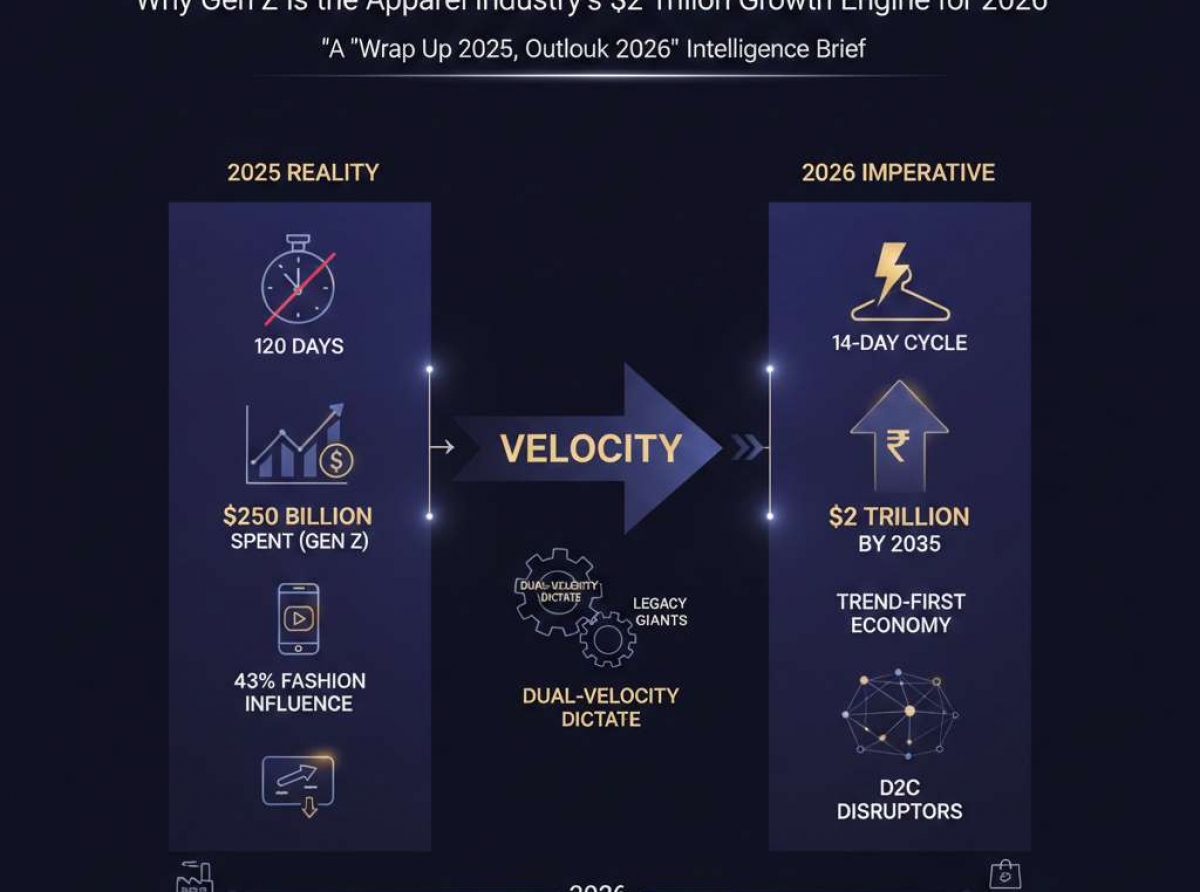

India’s Gen Z population has swelled to 380 million, the largest youth cohort globally, and their direct spending power in the apparel sector has officially hit the $250 billion mark as we enter 2026.

Read our latest issue

This demographic now influences a staggering 43% of India's total fashion expenditure, a figure projected to skyrocket to $2 trillion by 2035.

The commercial narrative for 2026 is driven by a simple, ruthless truth: the traditional 120-day fashion cycle is dead. In its place is a "Trend-First Economy" growing at an 11-13% CAGR, where the oldest Gen Zs are now nearly 29 years old, emerging as primary household decision-makers, managers, and young parents.

They are dismantling legacy rules and replacing them with a high-velocity operating system that demands "affordable aspiration."

For established brands, ignoring this shift is no longer a strategic choice; it is a fast track to irrelevance.

The 2025 Apparel Post-Mortem: Speed and velocity as the ‘New Currency’

The year 2025 will be remembered as the "Velocity Shock" for the Indian garment trade. While legacy brands were still debating seasonal palettes, a new breed of "Ultra-Fast" Indian disruptors perfected the 14-day design-to-shelf cycle.

By leveraging fragmented, hyper-local manufacturing clusters in Tirupur and Surat, these players treated fashion as real-time digital currency.

They didn't just sell clothes; they sold physical manifestations of viral algorithms.

The data from 2025 confirms that the "Hyper-Value" segment—where everything sits under the ₹999 price point, grew by a massive 24% CAGR. This wasn't just a win for low-cost retailers; it was a structural shift in how volume is moved in India.

In 2026, the benchmark for "success" has moved from warehouse efficiency to "Trend Velocity", the speed at which a brand can translate a YouTube "vibe" into a retail rack.

Table 1: The 2025 Market Shift – A segment-wise snapshot

|

Segment |

2025 Growth |

Key Change Driver |

Dominant 2026 Trend |

|

Value Fashion |

24% CAGR |

Price integrity + Trend velocity |

Hyper-Fast "Micro-Drops" |

|

Premium/Super Premium |

18% CAGR |

Narrative-led exclusivity |

Quiet Luxury with a "Flex" |

|

Menswear |

15% YoY |

Casualization of Work |

Baggy Silhouettes & Utility |

|

Womenswear |

22% YoY |

Social-First "Viral" Designs |

Co-ords & Y2K Revival |

|

Kidswear |

12% YoY |

Gen Z Parenting Aesthetics |

Mini-Streetwear & Gender-Neutral |

The 2026 Outlook: C-Suite strategy & the legacy shift

For the C-Suite of established legacy brands, the mandate for 2026 is the "Dual-Velocity Dictate." Leaders must maintain the high-margin stability of their traditional Gen X and Millennial base while aggressively building a separate, high-speed infrastructure for Gen Z.

This involves a radical bifurcation of the brand. Rather than forcing a heritage brand to "act young", which often alienates the core and fails to convince the youth, smart retailers like ABFRL and Reliance are ring-fencing Gen Z operations into independent, agile sub-labels.

Strategic leadership is now weaponizing physical moats. In 2026, we are seeing the rise of the "Showroom-and-Ship" model. Established retailers are converting portions of their massive store networks into dark stores for 10-minute delivery apps.

They are also investing heavily in "Vertical Mastery," owning the supply chain from loom to rack to stabilize EBITDA margins, which remain under pressure at 5-8% for pure-play fast fashion disruptors.

Table 2: Strategic Outlook 2026 – The “Dual-Velocity’ playbook

|

Metric |

Legacy Giants (2026 Strategy) |

D2C Disruptors (2026 Strategy) |

|

Lead Time |

35–45 Days (Reduced from 180) |

12–18 Days |

|

Inventory Refresh |

Monthly Capsules |

Weekly Viral Drops |

|

Supply Chain |

Vertical Integration; Monthly Drops |

Fragmented Hyper-Local Clusters |

|

Retail Format |

Phygital Hubs + Dark Store Utility |

Pop-ups + Social Commerce Checkout |

|

Primary Channel |

Omnichannel (Loyalty-driven) |

Social Video (Discovery-driven) |

Trend-First Commerce: Social video as the storefront

The defining commercial driver for 2026 is the total convergence of content and checkout. With social commerce projected to reach a $8.4 billion valuation in India this year, Instagram and YouTube have become the primary storefronts.

Gen Z doesn't "go shopping"; they live in a state of continuous discovery. This has forced a shift in retail formats from "distribution hubs" to "content studios."

The 2026 store is an immersive stage. Success is now measured by how many "Social Shares" a fitting room generates. Legacy brands are responding by integrating AR mirrors and creator-led kiosks. Crucially, they are adopting the "Social Commerce License"—ensuring that the product seen in a 15-second reel is available for purchase and delivered within the hour.

This "Hyper-Personalized" approach is what allows them to compete with nimble D2C startups while retaining their mainstream market's trust in quality and fit.

Sectoral Deep Dive: From ‘Flex-Culture’ to aspirational premium

The impact of this behavior is reshaping every sector. In Menswear, the "suit" has been replaced by structured coordinates, driven by a desire for "flex-ready" apparel that works for both the office and the social feed.

Womenswear is seeing a 26% growth forecast for 2026, dominated by designs engineered for the camera, prioritizing silhouette and bold colors over traditional durability.

In the Premium segment, we are witnessing the rise of "Affordable Aspiration." Gen Z is willing to pay more for brands that offer "Narrative Value", transparency in sustainability or a unique cultural story. Interestingly, the Kidswear sector is being overhauled by Gen Z parents who are rejecting traditional gendered tropes in favor of mini-me streetwear, a niche expected to grow at 13% CAGR.

Table 3: 2026 Gen Z consumer behavior & retail impact

|

Consumer Metric |

2025 Observation |

2026 Target/Response |

|

Purchase Driver |

Price & Trend |

"Vibe," Narrative & Values |

|

Shopping Hub |

Marketplace Apps |

Native Social Checkout |

|

Brand Loyalty |

Low (Price-sensitive) |

Moderate (Community-driven) |

|

Retail Need |

Inventory Depth |

Experience & Instant Gratification |

|

Sustainability |

Premium Niche |

Baseline "Table-Stakes" |

Editor’s Conclusion: The survival of the most meaningful

As we wrap up 2025, it is clear that the "Gen Z Effect" was never a temporary trend—it was a structural reset of the global retail operating system. For the legacy players, the lesson of the past year is that heritage is a double-edged sword.

While it provides the capital to scale, it can also act as an anchor that prevents the speed required to survive.

The winners of 2026 will be the "Agile Institutions", those that can marry the 14-day supply chain of a startup with the ethical scale and quality of a legacy giant.

We are entering an era where "Meaningful Speed" beats "Raw Speed." The recalibration is complete.

The question for every boardroom in 2026 is no longer if they should address Gen Z, but whether they can build a supply chain fast enough to catch up to a generation that moves at the speed of light.